Set up Xero Practice Manager with the help of our skilled consultants, and get your follow operating easily very quickly. Select the option that works best for you and walk away with a new apply management resolution. We know it’s a challenge having to verify multiple places and replace data in multiple tool. So we’ve introduced Xero Practice Supervisor and Xero Tax collectively, to minimise knowledge entry and repetitive duties for your group.

If you’d prefer to explore the choices out there to you when establishing Xero Follow Supervisor, have a look at our help for implementing Xero in your practice page. And should you’re a Xero Partner with silver standing or above, the subscription is free. Read our case examine to know how one firm is utilising Xero Follow Manager to evolve and take higher care of itself and its purchasers. From the first consumer proposal to the ultimate bill, Xero Follow Supervisor has the functionality to support you.

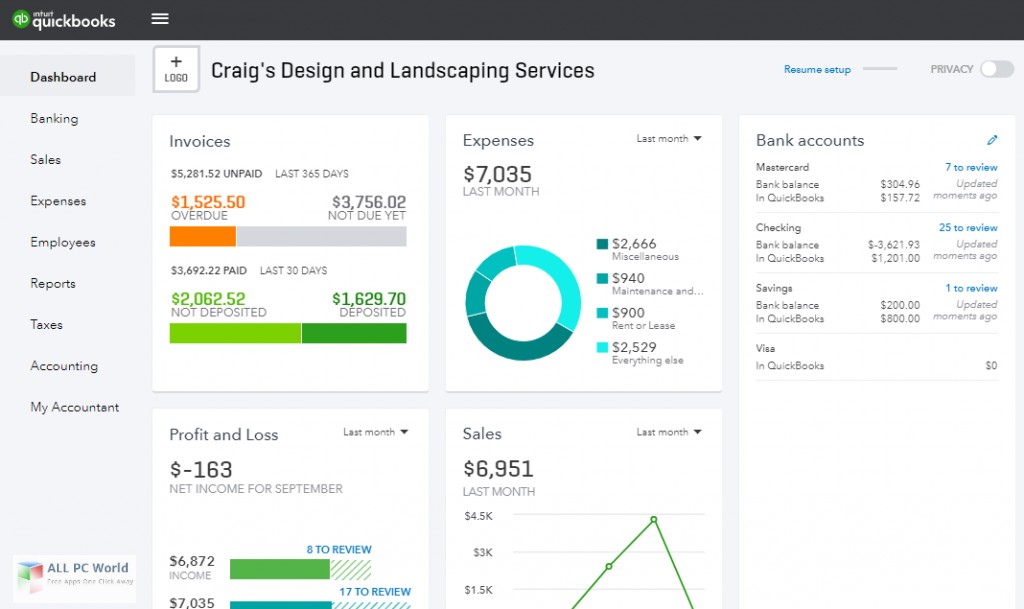

Better but, you can get forward of money circulate challenges or spot different obstacles before they affect your clients, and supply support ahead of time. Having a single device for several duties could make your daily workload much more manageable. The alternative is a quantity of, disconnected programs that require you to replace everyone individually. There’s no single source of truth, and the information you work with isn’t updated and infrequently doesn’t replicate your true apply or shopper image. Run normal reviews, customise pattern stories, or construct your own using Xero’s apply management software program.. Run normal reports, customise sample stories, or construct your own utilizing Xero’s follow management software.

Get Began With Xero Follow Supervisor

- Change information between Xero Apply Manager and different Xero apply instruments, Xero HQ and Xero Workpapers.

- This means you don’t have to verify a number of places to see if the latest invoice has been paid – everything’s ready in Xero Apply Manager.

- Xero Follow Manager is free for accounting and bookkeeping practices who’ve reached silver, gold or platinum status on the Xero partner programme.

- Customise templates to create and assign jobs to workers and look up their schedules using Xero’s practice management software.

If you are an current Xero associate you’ll be able to log in and take a look at it free for 14 days. The platform covers jobs, timesheets, invoicing, detailed consumer management and insights, and reporting. Receive timesheets from your workers, which can be utilized to populate shopper invoices for billable work.

Whether Or Not you’re onboarding new purchasers or filing tax returns, having a single system to handle practice manager xero all duties enhances your effectivity, accuracy, and compliance. Run your firm’s personal accounts on Xero at no cost, and connect them to Xero’s follow administration software. Uncover tips on how to manage staff and their entry to purchasers utilizing our follow instruments. You can onboard employees in a single place to achieve access to Xero HQ, Xero Tax, and Xero Follow Supervisor. You’ll have the flexibility to see enterprise well being, income, and bills on your clients at a look. So after they come to you with questions, you probably can pull up the latest information and advise them accordingly.

Run Your Accounting Apply Extra Effectively With Xpm

Xero Apply Supervisor is the all-in-one follow administration device for our accounting companions. We advocate that practices with as a lot as one hundred fifty purchasers and 10 staff members observe the self-implementation route of setting up XPM. With Xero Apply Supervisor and Xero Tax integrated, you will get real-time insights on the roles in progress to help you prioritise work and ship well timed help.

XPM integrates seamlessly with Xero and shares shopper records with Xero HQ making a single source of truth. Practices which have 3+ employees and more than 200 purchasers would profit from the facility of XPM. Connect over 50 related apps to complete your apply app stack and get the ability of Xero Tax in NZ and AU. Customize templates to create and assign jobs to staff and look up their schedules using Xero’s practice administration software program.

Enter And Review Shopper Information

Use Xero Practice Supervisor because the core of your corporation and integrate it with your accounting, payroll, buyer assist, CRM software and over 30 different world-class add-on apps. As Xero Practice Manager evolves, we’ll hold finding ways to make the system more useful and valuable for you and your purchasers. The solutions we covered here are available for you at present – simply sign up for the companion programme to discover them.

Xero Follow Manager is free for accounting and bookkeeping practices who are members of the Xero associate program and have reached silver, gold or platinum status. This single workers expertise will assist you to keep data secure and protected, in compliance with data protection regulations. However it additionally makes onboarding and offboarding simpler, because your staff has entry to the best details about clients and jobs on the right time. Xero Apply Manager is free for accounting and bookkeeping practices who’ve reached silver, gold or platinum standing on the Xero partner program. If you are an existing Xero companion, you’ll have the ability to log in and try it free for 14 days. Change data between Xero Follow Manager and different Xero follow tools, Xero HQ and Xero Workpapers.

Once you’re a associate, you possibly can sign as much as take a look at new options – just like the built-in Xero Practice Manager and Tax beta – by turning into a Xero Insider. We’ve additionally added extra capabilities to staff roles and permissions together with access to client Xero organisation to give you extra control over how information is used and shared. You can now set workers entry and permissions throughout the whole Xero suite, immediately from Apply Manager. Xero Apply Manager is related to the relaxation of Xero, so your client and staff records are synced throughout the platform. This means you don’t need to examine a quantity of locations to see if the newest invoice has been paid – everything’s ready in Xero Apply Manager.

Soon our UK clients get compliance and apply management https://www.bookkeeping-reviews.com/ tools as one single expertise making it a lot quicker to organize and file accurate accounts. This means you don’t need to work with separate knowledge sets – the knowledge in Xero’s core bookkeeping device will flow effortlessly between Tax and Follow Manager. Run normal reports, customize pattern stories, or build your own utilizing Xero’s apply management software program.